- Home

- Sustainability

- Governance

Governance

Corporate Governance

Policies

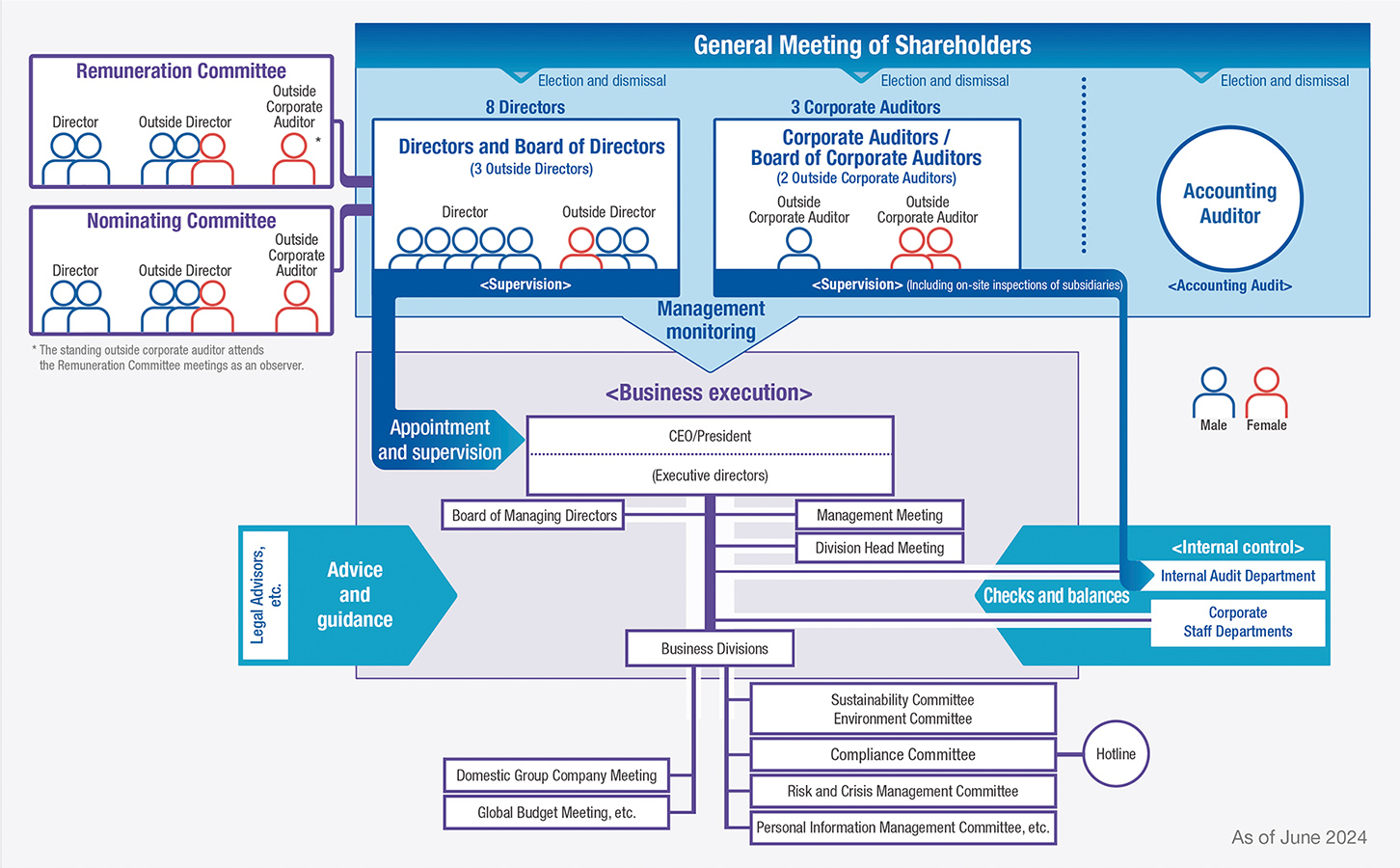

To maximize our corporate and shareholder values, we recognize the importance of establishing a fair and sound corporate management system and a managerial structure that enables quick and accurate decision making to accommodate an ever-changing business environment, and the execution of legitimate and appropriate business operations. To that end, we are working to improve and enhance our approach to corporate governance.

Board of Directors

The Board of Directors meetings are held regularly on a monthly basis, in principle, and whenever necessary to discuss and decide important agenda items and the execution of important business concerning the Group’s management policies and strategies. It also supervises the management from an independent and objective standpoint.

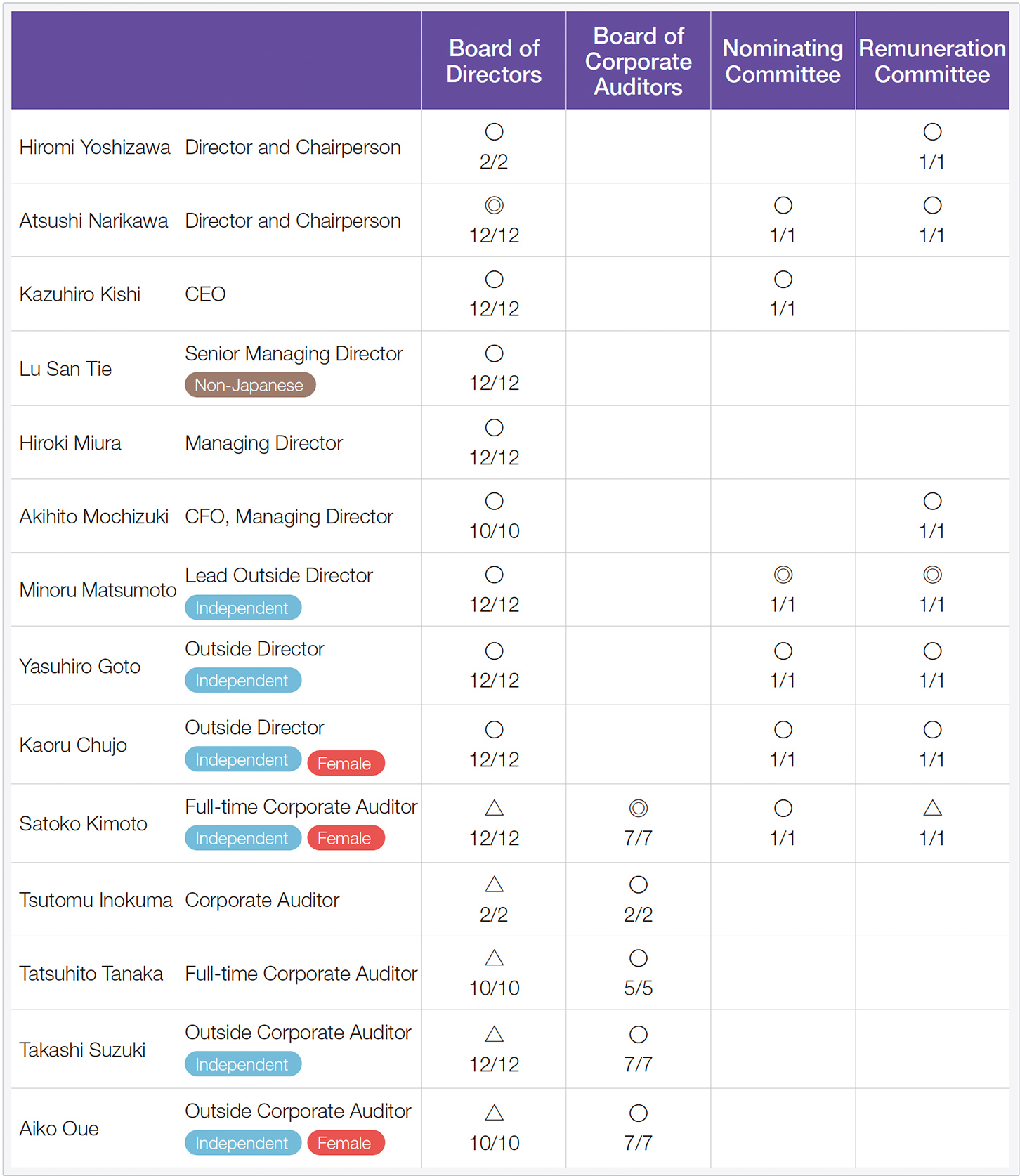

Members of the Board of Directors and their attendance at its meetings

The Board of Directors meeting currently consists of eight directors and four corporate auditors present. Seven of the meeting attendants (three independent outside directors and four corporate auditors), who constitute the majority, are in a position to supervise or audit management from an independent standpoint. In addition, the Board of Directors is chaired by the president. Because we are in a period of business transformation, with many agenda items related to important business execution, we believe that the smooth operation of the Board of Directors is enabled by having the president, who is familiar with the status of business execution and the internal situation, host the meetings as the chair. In addition, sessions for exchanges of views between directors, which are hosted by independent directors, are held to increase the effectiveness of the Board of Directors. Members of the Board of Directors and their attendance at its meetings are as shown in Table 1.

Major matters considered by the Board of Directors

The Board of Directors vote on important matters related to business execution, including management policies, business plans, and sustainability-related issues, in addition to agenda for the general meeting of shareholders and legal matters for resolution. Progress in important matters of business execution is also reported. Matters to be reported include those requested at sessions for exchanges of views between independent directors and corporate auditors and among independent officers, leading to a lively exchange of opinions.

Board of Corporate Auditors

Corporate auditors attend the Board of Directors meetings and other important meetings to audit the execution of duties by following audit standards, policies, and other rules set by the Board of Corporate Auditors.

Members of the Board of Corporate Auditors and their attendance at its meetings

The Board of Corporate Auditors consists of four members (including three independent corporate auditors). Each auditor has considerable knowledge in accounting, tax affairs, or legal affairs. Members of the Board of Corporate Auditors and their attendance at its meetings are as shown in Table 1.

Major matters considered by the Board of Corporate Auditors

They include audit policies, the legality of business reports and annexed detailed statements, the legality of the execution of duties by directors, the internal control system and its status of operation, and the reasonableness of the methods and results of audits conducted by the accounting auditor.

Table 1: Activities of each director and corporate auditor in the Board of Directors, Board of Corporate Auditors, and arbitrary committees (April 2024 to March 2025)

◎: Chairperson, 〇: Member, △: Attendant

(Note)

1. Mr. Yasuhide Takahara was appointed as Managing Director at the 90th Ordinary General Meeting of Shareholders of the Company that was held on June 26, 2024.

2. Mr. Naoki Kanai was appointed as Director at the 90th Ordinary General Meeting of Shareholders of the Company that was held on June 26, 2024.

3. Mr. Lu San Tie resigned at the close of the 90th Ordinary General Meeting of Shareholders of the Company that was held on June 26, 2024.

4. Mr. Takashi Suzuki resigned at the close of the 90th Ordinary General Meeting of Shareholders of the Company that was held on June 26, 2024.

Status of Activities of the Nominating Committee

The committee is chaired by the lead independent outside director and its members are three independent directors, two directors, and the independent corporate auditor.

To ensure the fair, transparent selection and appointment, etc. of officers (directors and corporate auditors), the committee drafts agendas on appointment or dismissal of directors and corporate auditors that the Board of Directors submit to the general meeting of shareholders, as well as agenda items on the appointment or dismissal of the president for the Board of Directors meetings. In the process of appointing the president, the committee has the authority to select a succession plan and candidates and interview the candidates.

In the last fiscal year, this committee met once.

- Discussion of specific criteria for the selection of CEO candidates

- Interviews with CEO candidates

- Selection of CEO candidates

- Selection of candidates for directors and corporate auditors to be submitted to the 91th Ordinary General Meeting of Shareholders and submission of the candidates to the Board of Directors and the Board of Corporate Auditors

The status of attendance of each member is as shown in Table 1.

Status of Activities of the Remuneration Committee

The committee is chaired by the lead independent outside director and its members are three independent directors and two directors. The independent corporate auditor also attends its meetings as an observer.

This committee has the authority to determine the director remuneration system, criteria, and policies and content of remuneration of individual directors, within the amount limits set by resolution by the general meeting of shareholders and within the scope specified in internal regulations on remuneration, so as to ensure fair, transparent decisions on directors' remuneration, their treatment, and other areas.

In the last fiscal year, this committee met once.

- Review of business performance of the overall company and each division in the last fiscal year

- Evaluation of individuals based on the above for performance-linked remuneration for the fiscal year

- Review of the progress of the mid-term business plan and evaluation of mid- to long-term performance based on the above

- Evaluation of individuals for performance-linked remuneration

The total amount of remuneration of directors was submitted for discussion at the Board of Directors meeting held on June 25, 2025 and received approval. Regarding the amount of remuneration of each director (and each executive officer), it was resolved that the Board of Directors would leave the decision to the committee within the total amount and the scope set forth in the internal regulations on remuneration of directors, etc.

The status of attendance of each member is as shown in Table 1.

Sessions for Exchange of Views between Officers

We hold the following sessions for exchanging views for the purpose of strengthening corporate governance. At each session, attendants have unrestricted, constructive discussion and exchange of views, including the presentation of problems. The content is utilized for the discussion and operation of the Board of Directors, supervision of management, business execution, and other purposes.

Evaluation of Effectiveness of the Board of Directors

To increase the effectiveness of the Board of Directors, we evaluate its effectiveness based on questionnaires filled out by directors and corporate auditors. We also use the results of the surveys in the operations of the Board of Directors.

Overview of results of the effectiveness evaluation of the Board of Directors

1. Last fiscal year (FY2024)

- Composition

The Board of Directors has a well-balanced composition, with internal and external officers with diverse experience and insights. Its size is appropriate for having sufficient communications and lively discussions. Meanwhile, appointing directors with expertise in investor perspectives, technology and R&D, and comprehensive strategic judgment, as well as recruiting foreign nationals, remain challenges for the future. - Status of operation

To help the Board of Directors conduct meaningful discussions, materials are distributed to its members before a meeting is held, thus having them understand the background, purpose, and content of each agenda. In addition, where necessary, explanations are given by the secretariat to the Board of Directors or others. The set frequency of meetings is also appropriate. While improvements have been made in the early presentation of materials, there is room for improvement in the earlier provision of materials and prior explanations to outside officers. In addition, in the case of an important matter, holding repeated deliberations, such as holding an extraordinary meeting of the Board of Directors without waiting for a regular meeting, will further vitalize the operations of the Board of Directors. - Status of deliberations

As a result of the extended duration of each Board of Directors meeting, effectiveness has been increased with more thorough explanations of each agenda item, sufficient time provided for questions, answers and discussion, and unrestricted, constructive discussion and exchanges of views, among other improvements. Moving forward, deliberations need to be enhanced by checking the actual conditions and situation of businesses at each overseas site, and discussion of important matters, such as the mid-term business plan, needs to be enhanced.

2. Future initiatives

In light of the results of evaluation for the last fiscal year, the following initiatives will be taken in an attempt to enhance deliberations by the Board of Directors and further increase its effectiveness.

- Presenting materials earlier, ensuring the early provision of materials about important matters, and improving prior explanations about such matters

- Enhancing deliberations of management strategies and important matters and follow-up reporting

- Enhancing deliberations by checking the actual conditions and situation of businesses at each overseas site

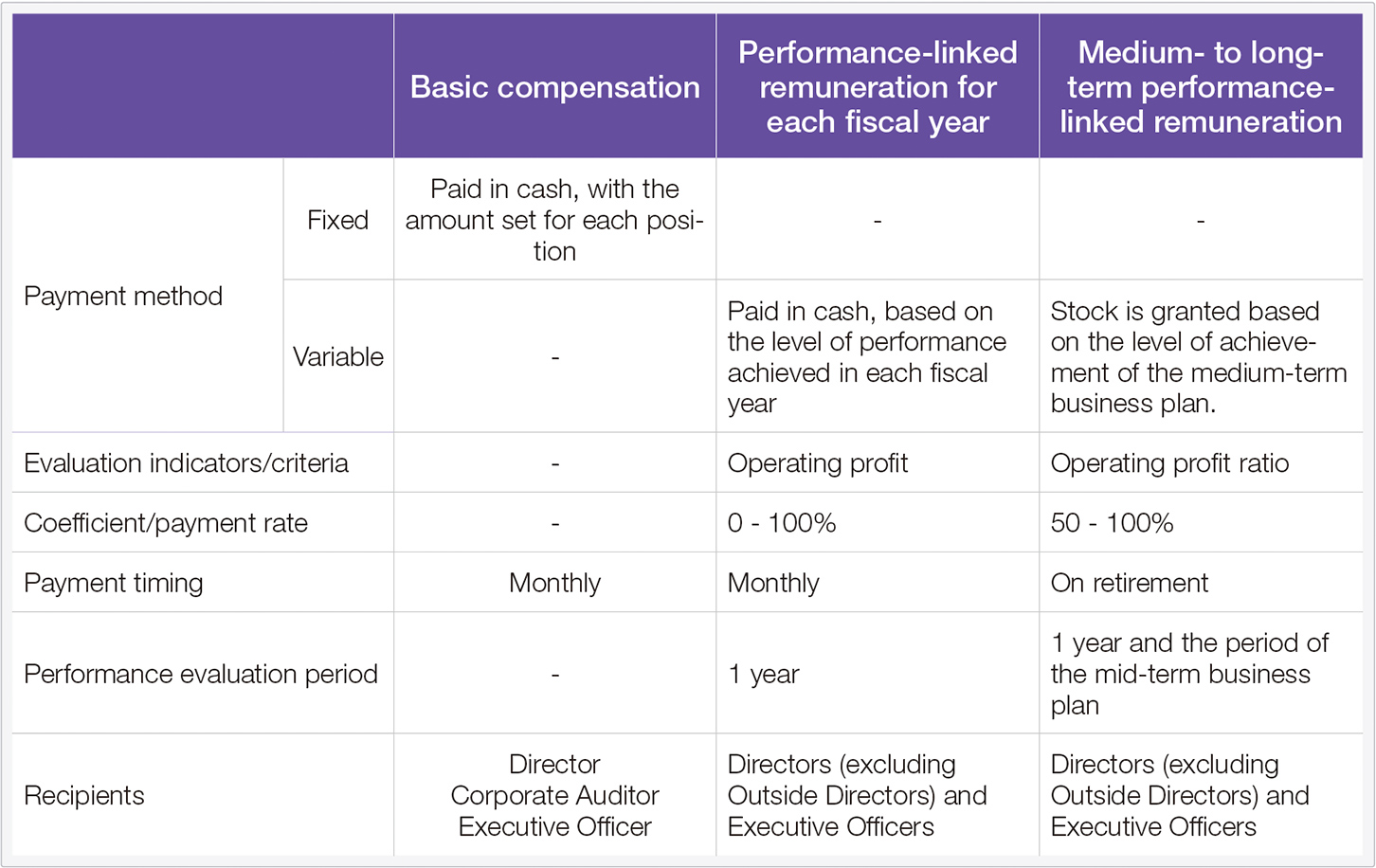

Overview of Officer Remuneration System

The remuneration of directors and corporate auditors is paid in such a way that the amount will not exceed the limit on remuneration, a resolution on which was passed at the general meeting of shareholders.

Regarding the remuneration of directors, the remuneration system, criteria, and policies and content of remuneration of individual directors are determined by the Remuneration Committee so as to ensure fair, transparent decisions on directors’ remuneration, their treatment, and other aspects.

The remuneration of internal directors consists of the basic remuneration, performance-linked remuneration, and stock remuneration for each position. The system, criteria, and policies for the remuneration of corporate auditors and the contents of remuneration of individual corporate auditors are determined by the Board of Corporate Auditors.

Corporate Governance Guidelines

The Foster Group has established Corporate Governance Guidelines that express our basic way of thinking and framework with regard to corporate governance.

Corporate Governance Guidelines (available in Japanese)![]() (PDF:168KB)

(PDF:168KB)

Foster Group Corporate Action Guidelines

The Foster Group has established Corporate Action Guidelines that express our actions with public decency in compliance with laws and regulations inside and outside Japan, international rules, and their spirit and intent as well as corporate ethics.

- Foster Group Corporate Action Guidelines

(PDF:17KB)

(PDF:17KB)

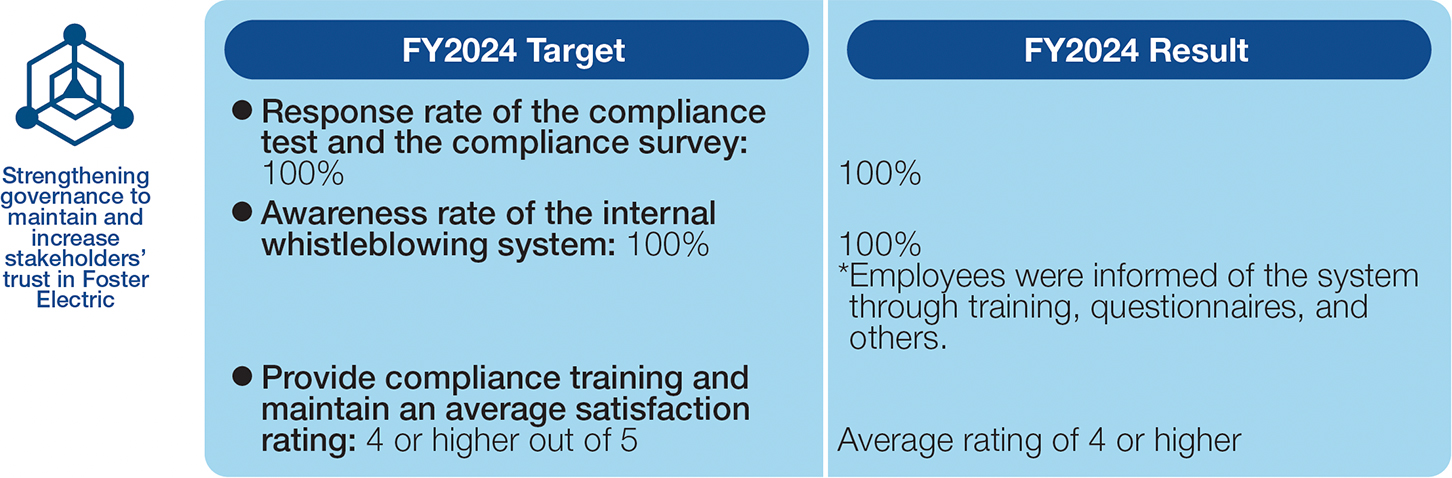

Compliance

Policies

The Foster Group emphasizes compliance (with laws, regulations and corporate ethics) as a core element of its CSR philosophy and promotes a compliance program—setting internal rules and building a structure for management—to all Group companies.

Compliance Structure

In promoting a compliance program, emphasis should be placed on a whistleblowing system that serves as a self-cleansing mechanism. Such system is under operation through “the Compliance Hotline” and “Harassment Helpline” that connects whistleblowers to external corporate lawyers available for 24 hours by email. Internally, the highly independent internal audit office and HR representative act as a window to early detect violations of compliance. The whistleblowing hotline is extensively available to employees and officers of the entire Group as well as to their families and the employees of business associates. We also hold briefings on the Compliance Hotline and Harassment Helpline for employees, to ensure that they are fully informed of the internal whistleblowing system.

It is also important to fully consider the protection of whistle-blowers and establish and disseminate internal regulations, including internal reporting regulations, to ensure that employees are treated fairly or not involved in any trouble as a result of their actions. Partly reflecting the revision of the Whistleblower Protection Act, our internal reporting regulations clearly state that the obligation to maintain the confidentiality of information that enables the whistleblower to be identified shall be ensured, and that any violation of the prohibition of searching for the whistleblower and prohibition of retaliation against and disadvantageous treatment of the whistleblower may result in disciplinary action.

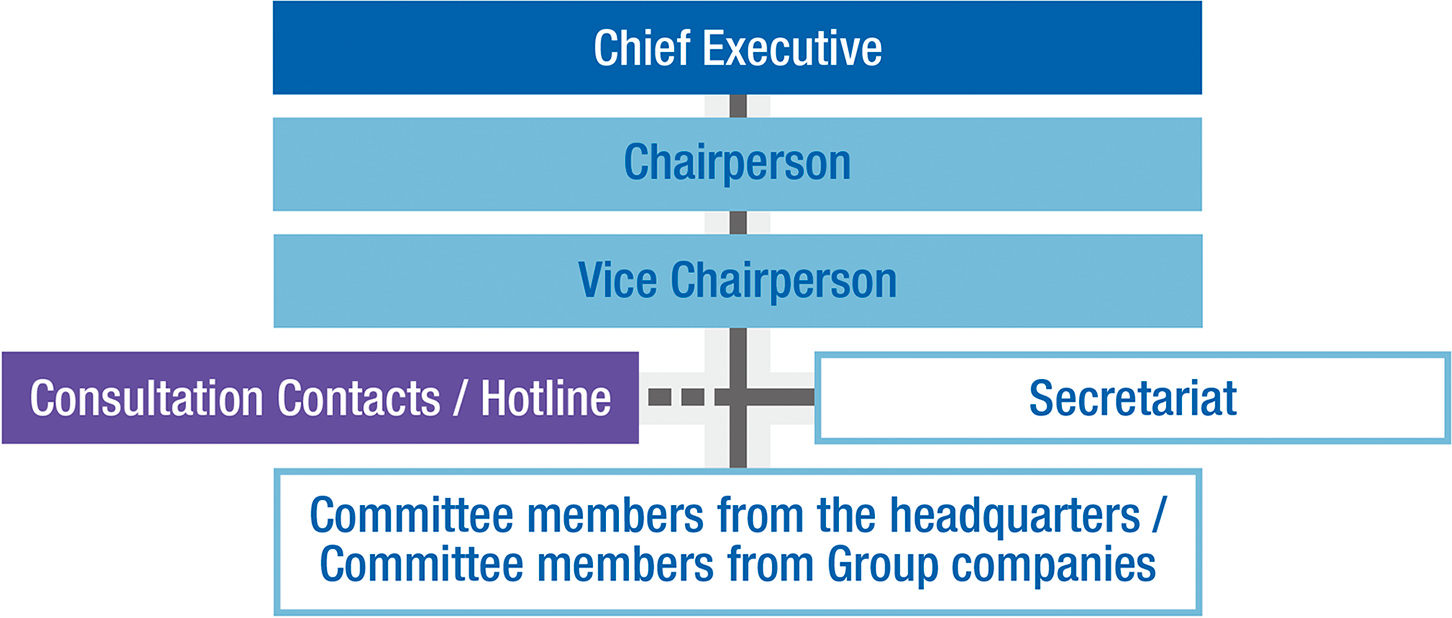

Compliance Committee

The Compliance Committee leads compliance programs with the president serving as chief executive. This committee was set up in accordance with “the Foster Group Code of Conduct for Staff.”

In fiscal 2024, we conducted a compliance test and a questionnaire on overall compliance matters, including “the Foster Group Code of Conduct for Staff.” We also provided online compliance training for all employees on the Subcontract Act, export management, and the prevention of bribery and corrupt practices, as well as compliance training, including harassment prevention, conducted by the corporate lawyers. Through these initiatives, we worked to raise employee awareness of compliance.

Organization of the Compliance Committee

(The same applies to the Risk and Crisis Management Committee)

Anti-corruption Initiatives

Our basic approach to anti-corruption is set out in the “Foster Group Code of Conduct for Staff,” and we have been instilling it among officers and all employees. We have also established a framework to prevent bribery of government officials and excessive entertainment and gift-giving to and from private individuals. We have also enacted the Regulations for Preventing Bribery, etc. to prevent corrupt practices. Violations of anti-corruption laws and regulations, the Foster Group Code of Conduct for Staff, the Regulations for Preventing Bribery, etc., and other internal rules and regulations are to be reported to the Compliance Hotline.

Risk Management

Policies

The Foster Group is focused on predicting risks and taking preventive measures so that such risks will not materialize. They also focus on minimizing damage to the Company should a risk develop and materialize, resulting in the occurrence of danger. Specifically, we are working to make the risk control matrix (RCM) framework more sophisticated and to reinforce our structure for managing and sharing information under the basic operating policy of "being prepared for forward-looking risk and crisis management."

Risk Management Structure

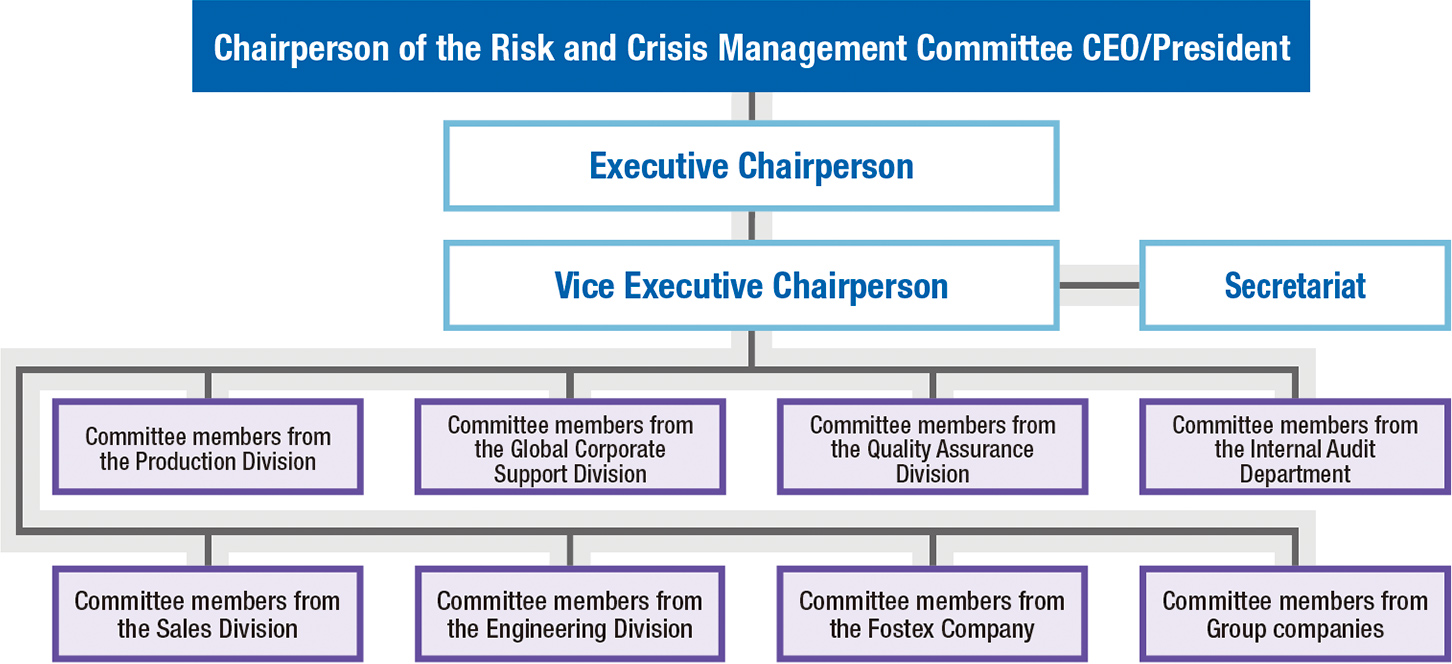

As the foundations for “the Foster Group's risk management structure,” we have established the Rules on Risk and Crisis Management and the Risk and Crisis Management Committee with the president as the chairman to identify risks using a checklist, analyze such risks and promote preventive measures on a Foster Electric-wide basis.

In the event of any incidents or accidents, we minimize the damage and restore the situation to our original state as quickly as possible. We also establish a crisis task force, mainly consisting of Risk and Crisis Management Committee members, and take other prompt measures to prevent any recurrence.

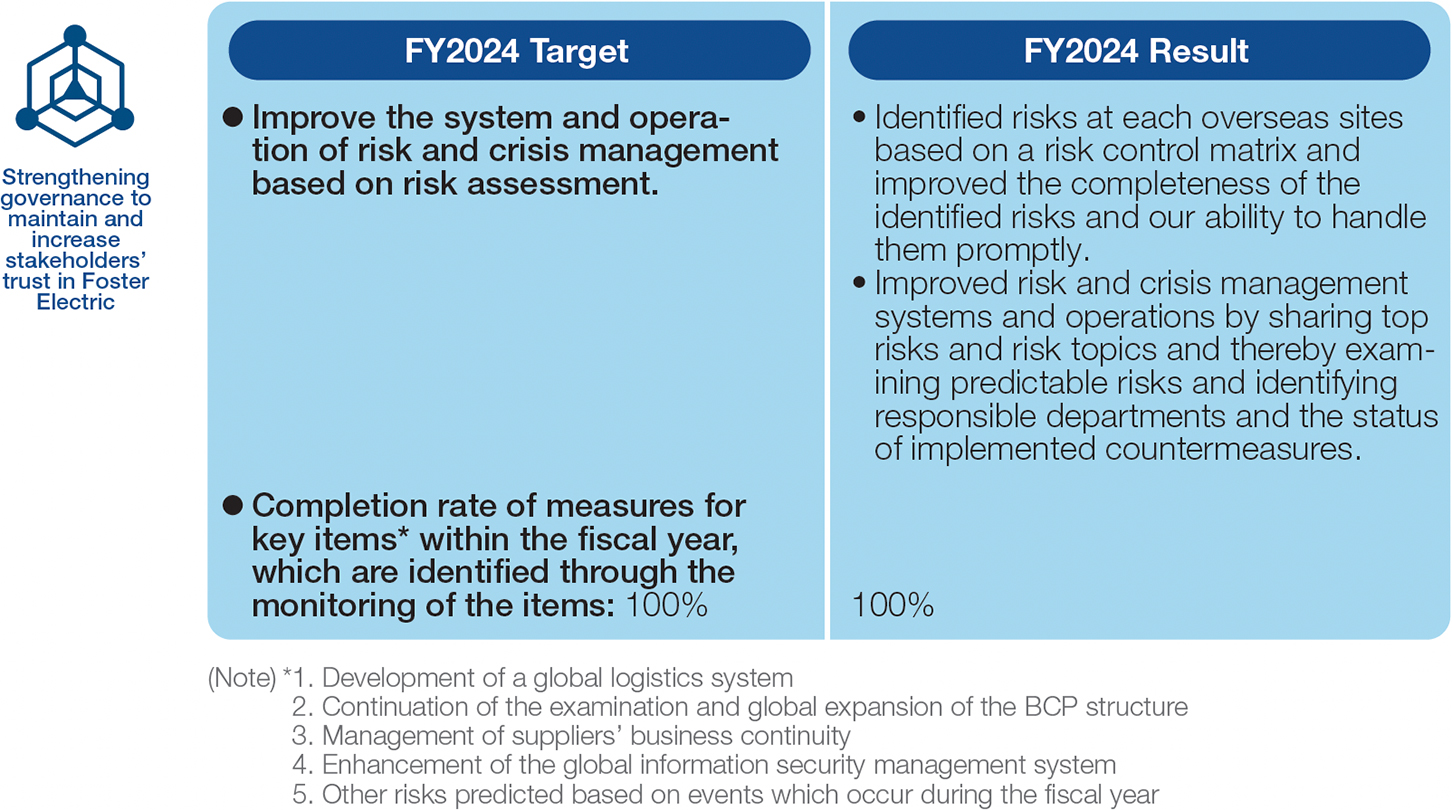

Risk and Crisis Management Committee

The Committee identifies and evaluates risks based on the result of risk reexamination conducted by respective department each year. From among risks, the Committee selects important risk items that it needs to control. We specifically monitor the status of responses to important risk items, top risks that have materialized, and risk topics expected to impact the company in the future, through regular meetings of the Committee, which are held every three months. The risk evaluation result is also referenced during the business policy planning. The Committee reports the status of its activities, the risks faced by the Group, and the measures that have been taken to address those risks to the Board of Directors as appropriate. This enables the Board of Directors to exercise its function of supervising risk management, including advice and guidance based on the specialized knowledge of independent directors. Our important risk items that were monitored in fiscal 2024 included the continuation of the validation and global expansion of the BCP structure, the global reinforcement of the information security management system, suppliers’ business continuity management, and the development of a global logistics system.

*The same applies to the Compliance Committee

Business Continuity Plan (BCP)

Policies

The Foster Group will prevent and avoid various business risks and crises. The Group promotes initiatives to build a global system for addressing risks that materialize or occur by prioritizing the minimization of damage to the Group and avoiding inconveniences to customers, with the cooperation and assistance of its supply chain.

Activity Promotion Structure

The Foster Group promotes business continuity through the function recovery activities undertaken by each function department and through collaboration with Board of Directors and the task forces at each site in accordance with the decisions made by the Risk and Crisis Management Committee consisting of its senior management.

Main Activities and Measures

Operation of the emergency-contact system (Safety Confirmation System)

In Japan, which is a disaster-prone country, we operate our emergency-contact system and take initial response measures promptly.

Disaster-prevention activities

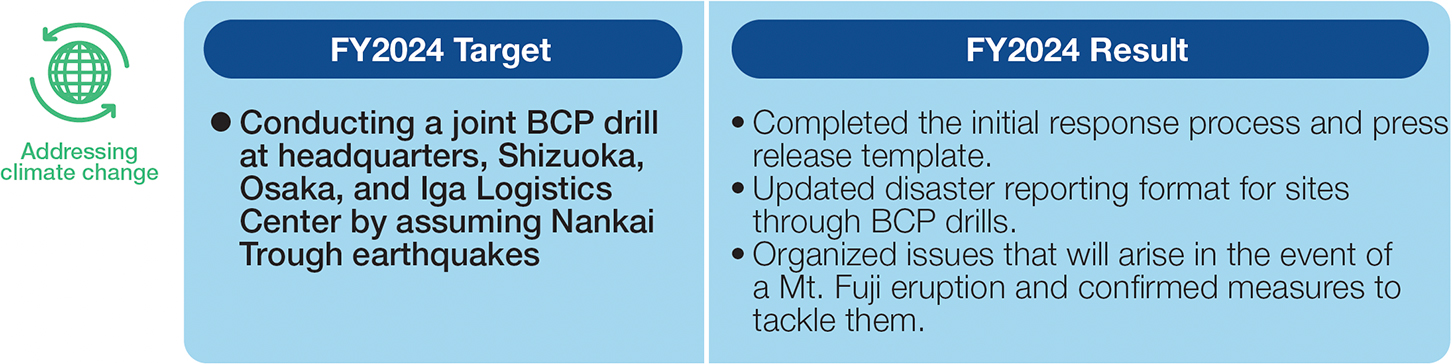

In fiscal 2024, we took the update to the probability of Nankai Trough earthquakes as an opportunity to have a BCP drill conducted jointly by our domestic facilities. Through preparations for the drill, we identified potential risks and carried out improvement activities. We are working to establish a BCP structure that has the resilience to withstand unforeseen circumstances. We also continued to sign disaster-prevention agreements with neighboring companies. In recent years, we will build a new disaster-prevention system which reflects our consideration of teleworking initiatives through workstyle reform.

Activities in the United Nations Global Compact

We signed the United Nations Global Compact and have participated in the Disaster Risk Reduction (DRR) Subcommittee since 2017. To fulfill the social roles expected of companies in disaster prevention and mitigation amid the increasing occurrence of major disasters across the world, we examine and implement specific contribution measures and take actions with an aim to implement the Sendai Framework for Disaster Risk Reduction and contribute to the achievement of the SDGs.

Pest control measures

We regularly take measures to prevent the occurrence of pests at overseas manufacturing sites. We thus prevent damages from pests including red imported fire ants, which have gone on the rampage in the past.

Disaster drills

At overseas sites, we conduct disaster drills once a year. With top priority given to the safety of employees, the drills are aimed at preparing for spread of infection as well as for a fire as in conventional drills.

Lecture on the handling of fire escape equipment given at the new office in Osaka

A pest control measure being taken at a factory in China

An infection control drill at a factory in Vietnam

Targets and Results

We carry out activities with a focus on the continuation of the validation and global expansion of the BCP structure. In fiscal 2024, we enhanced the level of our initial response capabilities through BCP drills, improved their contents, and established a framework for disaster scenarios.

Our Stance on Tax Matters

Basic Stance

The Foster Group works to maintain and improve tax compliance and perform proper filing and payment of taxes in accordance with the local tax-related laws and international rules based on its business and sustainable development strategies.

The Group does not make use of differences in tax-related laws between countries and regions to enjoy low tax rates without legitimate business purposes.

Governance

The Foster Group has established the global tax department within the Finance and Accounting Department of the Global Corporate Support Division at headquarters, so as to manage and monitor tax risks. Critical issues are reported to the top management including Board of Directors for their directions.

Conditions of Transactions with Related Parties Outside Japan

The Foster Group determines prices based on the arm’s length principle.

Relationship with Tax Authorities

The Foster Group provides information and otherwise responds to tax authorities in good faith. In addition, the Group has received a bilateral advance pricing arrangement (BAPA) to ensure the predictability of the application of transfer pricing taxation.

Ensuring Transparency and Responding to Income Taxes Concerning the Global Minimum Corporate Tax Rate

The Foster Group prepares and discloses its financial statements in compliance with the Financial Instruments and Exchange Act and related laws. It also discloses tax information in the financial statements based on the related laws and regulations.

The Group responds appropriately to income taxes concerning the global minimum corporate tax rate, which was established based on Pillar Two of the BEPS 2.0 project which has been discussed by the OECD and the G20. For example, the Group examines whether it fulfills exemption criteria based on Country-by-Country Reporting (CbCR).

Information Security

Policies

We recognize the importance of securing the trust of our customers, suppliers, shareholders, employees and other stakeholders based on our corporate creed of “Sincerity.” We also understand that appropriate management of information assets is an important part of the management agenda. To appropriately protect and handle the information assets possessed by the Group, we define the information security policies as follows:

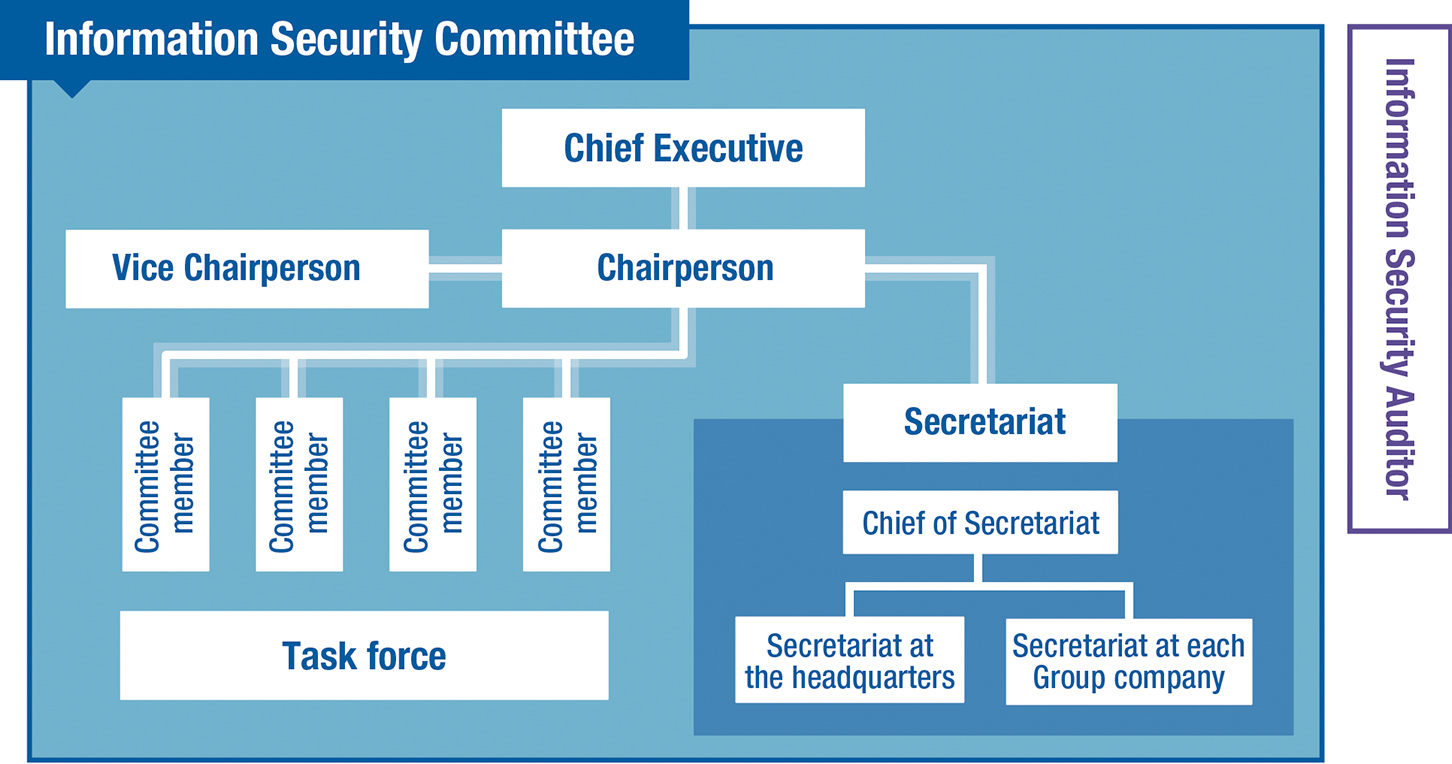

Activity Promotion Structure

For protection and appropriate management of all information assets possessed by the Group, it has established the Information Security Committee, whose members include the president serving as a chief executive and management, to maintain the system for understanding the management status of information security and prompt implementation of required security measures according to the risk analysis results.

Main Activities and Measures

The Group takes appropriate measures as organizational, human, physical and technical safety management initiatives against security threats, which change daily, to prevent unauthorized access, damage, leakage, falsification and other accidents involving information assets.

As part of our security enhancement measures, we will take regular actions including internal drills and third-party vulnerability assessments.

Acquisition of Certification

As a part of its measures to develop an information security management system and in response to customer requests, the Foster Group has acquired Trusted Information Security Assessment Exchange (TISAX) certification. TISAX is an information security standard for supply chains in the German automotive industry that was developed by VDA (Verband der Automobilindustrie), the German Association of the Automotive Industry.